Q: How do I access the portal to apply for forgiveness?

Go to the loan portal login page using Chrome, Firefox, or Safari. Please do not use Internet Explorer.

https://sccountybank-ppp-application.prod.apps.monjaco.com/portal/loans

If you forgot your password, please follow the instructions below:

If you are unable to log in after trying these steps, please reach out to sccountybank-support@monjaco.com.

Q: When can I apply for loan forgiveness?

The SBA is accepting applications for all 2020 and 2021 PPP loans. You may apply for forgiveness as soon as your covered period ends.

If you have a Draw 1 and Draw 2 PPP loan, forgiveness for the Draw 1 loan must be complete with the SBA before your Draw 2 forgiveness application can be submitted to the SBA.

Borrowers who have not applied for forgiveness within ten months of the end of their maximum covered period will be required to make principal and interest loan payments.

Example: Borrower A received a PPP loan on May 5, 2020. Borrower A chose a 24-week covered period. On October 20, their covered period ends and they are eligible to apply for PPP loan forgiveness. If Borrower A has not applied for loan forgiveness by August 20, 2021, they will be required to begin making principal and interest loan payments starting the following month.

Q: Can I use the SBA Forgiveness Portal?

Santa Cruz County Bank will not be opting-into the SBA Forgiveness Portal process, as it duplicates the process we already have in place. Working within our Portal, we are able to quickly respond to your needs and questions. Please continue to use the Santa Cruz County Bank Forgiveness Portal in order to ensure strong communication, consistent account management, and rapid forgiveness success.

Q: How do I determine whether this is my 2020 or 2021 PPP loan?

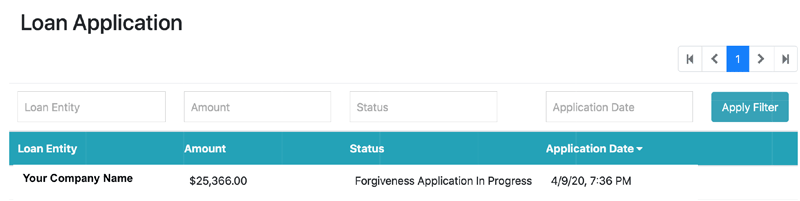

Please log into the portal. If the status for your loan says “Forgiveness Application Complete”, no action is needed.

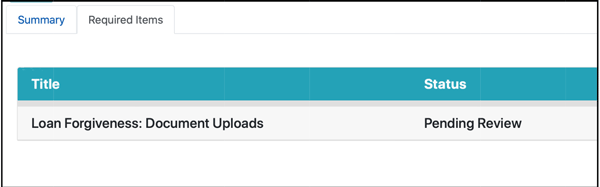

If another status is listed, please select that loan. Go to the "Required Items" tab at the top and click on the section stating "Waiting for Customer". Your PPP Analyst will communicate with you via the sections available to you, regarding what is needed to finish your forgiveness application.

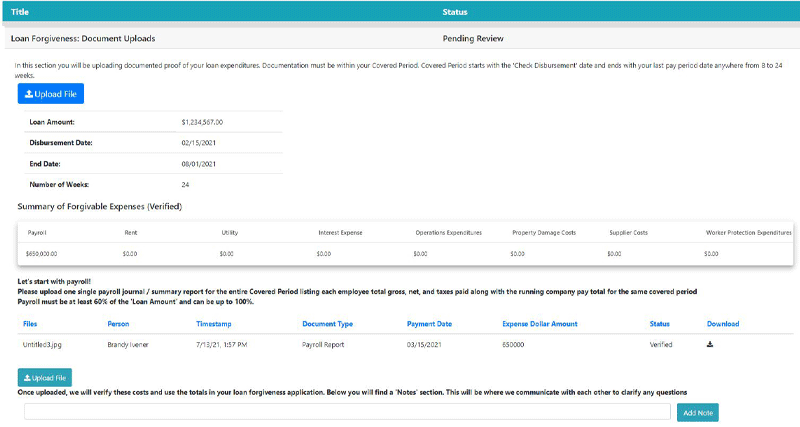

Q: Can I upload expense documentation now?

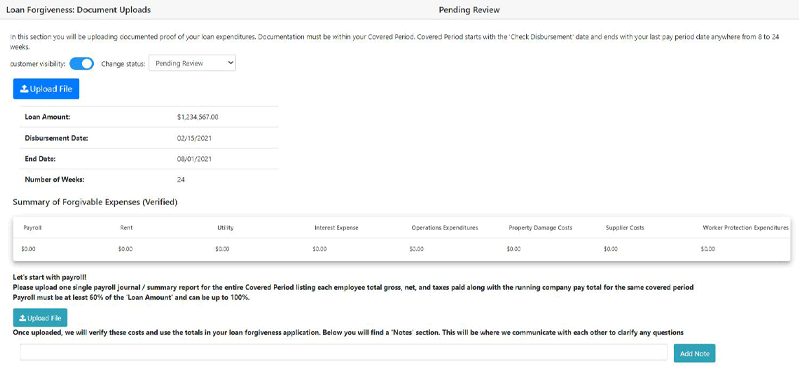

Yes. Only loans over $150K require documents and we recommend that you start this process as soon as possible. Please log into the portal and follow the instructions at the bottom of the "Required Items" section for the "Loan Forgiveness: Document Uploads" section available to you.

You can visit the SBA website for a comprehensive list of materials and loan forgiveness rules.

Q: Why is so much documentation required and why can’t you use what I have already provided?

A comprehensive list of materials and loan forgiveness rules under the SBA's guidelines can be found by visiting the SBA website .

More information may be requested because what has been provided does not meet these guidelines, or it may require clarification by the PPP Analyst. Additionally, the SBA may have requested additional proof that goes beyond what has already been submitted.

Please keep in mind our goal is to present your business documentation in the simplest format so that the SBA can easily evaluate your forgiveness.

Q: Why can't I click "Submit" on my forgiveness application?

Please log into the portal and go to the "Loan Forgiveness: Application" section. Scroll to the top of the that section. Review all "Require Fields = *" to make sure nothing is missed. Also, verify the check boxes are selected that are appropriate for your loan. Finally, make sure the "Borrower Certifications" section is initialed.

For borrowers with only a Draw 1 loan over $150K, please be sure to initial the question "If this application is being submitted for a Second Draw PPP Loan, the Borrower used all First Draw PPP Loan amounts on eligible expenses prior to disbursement of the Second Draw PPP Loan." You are simply acknowledging the statement, which is required for submitting the application to the SBA.

Q: What happens while my loan forgiveness application is being processed?

All payments (principal, interest, and fees) will be deferred until you receive a decision on your loan forgiveness application. However, interest will continue to accrue over this period.

Q: How long does it take for my loan forgiveness application to be processed?

Once we receive your loan forgiveness application, we will review it within 60 days, and then submit a decision to the SBA. The SBA has 90 days to review the submission.

Q: How do I know if my PPP loan is forgiven?

Please log into the portal. If the status for your loan says "Forgiveness Application Complete", no action is needed within the portal. Pursuant to the SBA guidelines, no documentation is required to show proof of forgiveness. However, a letter will be mailed to you, via USPS, stating the SBA's decision from Santa Cruz County Bank. Please allow for a minimum of two weeks for this letter to arrive, to account for processing time with the SBA and Santa Cruz County Bank.

Q: What happens if my entire loan is not forgiven?

For loans approved prior to June 5, 2020, any amount that is not forgiven will be treated as a 2-year loan with a 1% fixed interest rate. For loans approved on or after June 5, 2020, any amount that is not forgiven will be treated as a 5-year loan with a 1% fixed interest rate.

Q: Who determines the amount of loan forgiveness?

The U.S. Treasury and Small Business Administration (SBA) are responsible for the rules of the program which determine the amount of loan forgiveness. This can include full, partial or no forgiveness. Please visit SBA website .

Q: To qualify for 100% forgiveness how much of my expenses need to be used for payroll?

60% of the loan amount needs to be used for eligible payroll costs.

Q: What is the best place to get definitive information on the program?

We recommend getting your information on the program directly from the source, https://home.treasury.gov/policy-issues/cares/assistance-for-small-businesses .

Q: I've read all the information and need further assistance. What do I do?

Your local Small Business Development Center has staff ready and eager to assist you, https://www.santacruzsbdc.org/about-santa-cruz-small-business-development-center-northern-california-sbdc-network .

(Download this information as a pdf)

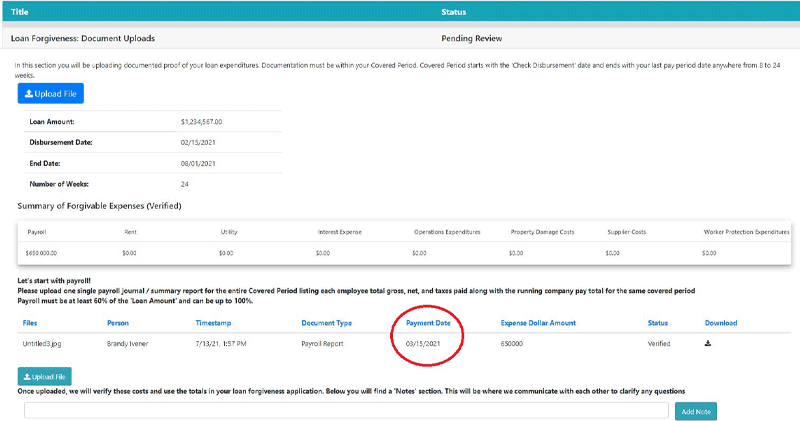

Q: I have uploaded a document, but it is not showing up on my Summary of Forgivable Expenses.

A: Be sure your document shows in the file list below the Summary of Forgivable Expenses and that the date falls within the correct date range, after your disbursement date and before the last week on the Summary of Forgivable Expenses.

Q: The status of my uploaded document is ‘Not Accepted’, what do I do?

A: Any document marked as ‘Not Accepted’ will be followed up with a note from our processing team indicating the required corrections. Documents that are ‘Not Accepted’ do not inherently indicate forgiveness ineligibility.

Q: I uploaded the wrong document, what do I do?

A: Leave a note for our processing team and we will remove the document.

Q: I mistyped the date or expense amount, what do I do?

A: Leave a note for our processing team and we will update the document details.

Q: I have fulfilled my payroll requirements & uploaded all supporting expense documentation. What do I do next?

A: Our team will reach out to you with the next steps for completing your forgiveness application.

March 9, 2021

Hello,

You are receiving this notice because you recently applied for a Small Business Administration (SBA) PPP loan with Santa Cruz County Bank as a Sole Proprietor, Independent Contractor, and/or Self-Employed Individual.

On March 3, the SBA issued new rules that may affect your eligibility for the program. We have updated our application, in accordance with the new rules, which includes the option to use alternate line-items on your Schedule-C or Schedule-F to calculate your eligible loan amount.

Due to the significance of this change, if you are interested in applying under the new rules, we require that you:

Our team has begun processing the new Sole Proprietor, Independent Contractor, and Self Employed Individual applications.

For information about the SBA PPP Program applications, rules, and FAQ, please visit: https://sccountybank.com/sba_cares_loan.cfm

We appreciate your trust in us.

Santa Cruz County Bank

January 5, 2021:

Hello,

You are receiving this communication because you have a Paycheck Protection Program (PPP) Loan with us.

We are pleased to share the most current information about the next round of Paycheck Protection Program (PPP) funding. While we await guidelines from the Small Business Administration, we have established a pre-application process for you, our existing borrowers who received PPP loan money in the first rounds.

To be eligible for this new PPP funding, all borrowers will need to demonstrate a 25% reduction in sales in any quarter of 2020 compared to the same quarter of 2019. For most borrowers, the maximum loan amount will be equal to 2.5 times 2019 monthly payroll expenses up to $2 million. For certain industries, such as restaurants and hotels, the maximum loan amount will be equal to 3.5 times 2019 monthly payroll expenses, up to $2 million.

Our pre-application is not a commitment to lend, it is based on the best information we have from the Small Business Administration (SBA) at this moment and may change. The SBA is responsible for setting the requirements for this program, which may require submission of additional documents, forms, information, or may have differing requirements.

To complete a pre-application for the Paycheck Protection Program (PPP) click the pre-application button at the top of this page. Please watch this page for additional information, Q & A, as well as updates to the program.

Last but not least, we call your attention to the importance of deposits and banking locally. We extend a tremendous THANK YOU to each of you who have established business accounts and a full relationship with us! Every deposit account with Santa Cruz County Bank is part of an important economic cycle. Your local deposits become loans to help local businesses start-up, expand, save jobs, survive the pandemic, and thrive.

We look forward to working with you again to secure funding.

Santa Cruz County Bank

October 15, 2020:

You are receiving this communication because you have a Paycheck Protection Program (PPP) Loan with us. In light of recent updates and clarifications by the U.S. Small Business Administration (SBA) to the Paycheck Protection Program, we’d like to share some information with you. If you have a loan for $50,000.00 or less, the information below on Forgiveness does not apply to you. We will reach out to borrowers with loans of $50,000.00 or less with a different set of instructions.

Forgiveness Applications for Borrowers with Loans of more than $50,000.00:

We have opened the Loan Forgiveness Application section for you in the portal. This section mirrors the SBA 3508EZ and 3508 forms, which allows for efficient review and verification of your forgiveness application, as well as submittal of the forgiveness judgement to the SBA.

If you have not yet done so, please be sure you have submitted documentation supporting your eligible payroll costs of at least 60% and the remaining eligible 40% costs within the portal. Payroll can be used to support 100% of your loan amount.

Please note that we are using the verified supporting documentation that you have provided within the Loan Forgiveness: Document Uploads section of the portal. If you have calculated an amount for a specific eligible cost that is higher than what is displayed in the Document Uploads section, you will need to provide additional supporting documentation that must be verified before moving forward. Only verified documents will be counted in the column totals. Based on new SBA Guidance, this includes 941 tax forms for your covered loan period, proof of payment via bank statements and/or cleared checks if not using a third-party payroll provider. Additionally, a copy of your lease agreement is required if you are submitting rent as a non-payroll cost.

Important Information for Borrowers with EIDL Advances:

If you received an EIDL Advance, the SBA is required to reduce your loan forgiveness amount by the amount of the EIDL Advance (Section 1110(e)(6) of the CARES Act). If you received an EIDL Advance in excess of or equal to the amount of your PPP loan, you will not receive any forgiveness on the PPP loan because the amount of the EIDL Advance is deducted from the PPP loan forgiveness amount.

UPDATES TO YOUR DEFERRAL PERIOD:

Clarifications to the SBA Paycheck Protection Program state that if you submit to your lender a Loan Forgiveness Application within 10 months after the end of your loan forgiveness covered period, you will not have to make any payments of principal or interest on your loan before the date on which the SBA remits the loan forgiveness amount on your loan to your lender (or notifies your lender that no loan forgiveness is allowed). Your lender must notify you of remittance by the SBA of the loan forgiveness amount (or notify you that the SBA determined that no loan forgiveness is allowed) and the date your first payment is due. If the loan is fully forgiven, the borrower is not responsible for any payments.

If only a portion of the loan is forgiven, or if the Forgiveness Application is denied, any remaining balance due on the loan must be repaid by the borrower on or before the maturity date of the loan. The borrower is responsible for paying the accrued interest on any amount of the loan that is not forgiven. Interest accrues during the time between the disbursement of the loan and SBA remittance of the forgiveness amount.

If you do not submit to your lender a Loan Forgiveness Application within 10 months after the end of your loan forgiveness covered period, you must begin paying principal and interest after that period.

For example, if a borrower's PPP loan is disbursed on June 25, 2020, the 24-week period ends on December 10, 2020. If the borrower does not submit a Loan Forgiveness Application to its lender by October 10, 2021, the borrower must begin making payments on or after October 10, 2021.

A complete Q&A from the U.S. Small Business Administration regarding the deferral period is available through this link: SBA PPP Loan Forgiveness FAQs - August

While we do our best to present clear and accurate information to you from the SBA they are ultimately responsible for the rules of the program and they can change them at any time. Any discrepancy between our communications and the SBA’s interpretation of the program will be governed by the SBA's guidance.

Please let us know if you have any questions by contacting: caresloans@sccountybank.com.

Thank you,

Santa Cruz County Bank

October 15, 2020:

You are receiving this communication because you have a Paycheck Protection Program (PPP) Loan with us. In light of recent updates and clarifications by the U.S. Small Business Administration (SBA) to the Paycheck Protection Program, we'd like to share some information with you.

Forgiveness Applications for Borrowers with Loans of $50,000.00 or less:

The release of a new forgiveness application, 3508S, for borrowers with loans of $50,000 or less, provides you streamlined access to forgiveness. This new application requires fewer calculations and less documentation for eligible borrowers. Additionally, borrowers who use the SBA Form 3508S are exempt from reduction in loan forgiveness amounts based on reduction in full-time equivalent (FTE) employees or in salaries or wages.

We are working diligently to open the Loan Forgiveness Application section in the portal to provide you access to the 3508S application. Once available, we will have many of the fields prefilled for your convenience. Once the application is available, we will notify you. You can then login to the portal, complete outstanding fields, review, sign, and submit the application.

If you have not yet done so, please be sure to submit documentation supporting your eligible payroll costs of at least 60% and the remaining eligible 40% costs within the portal. Payroll can be used to support 100% of your loan amount.

Please note that we are using the verified supporting documentation that you have provided within the Loan Forgiveness: Document Uploads section of the portal. If you have calculated an amount for a specific eligible cost that is higher than what is displayed in the Document Uploads section, you will need to provide additional supporting documentation that must be verified before moving forward. Only verified documents will be counted in the column totals. Based on new SBA Guidance, this includes 941 tax forms for your covered loan period, proof of payment via bank statements and/or cleared checks if not using a third-party payroll provider. Additionally, a copy of your lease agreement is required if you are submitting rent as a non-payroll cost.

Important Information For Borrowers with EIDL Advances:

If you received an EIDL Advance, the SBA is required to reduce your loan forgiveness amount by the amount of the EIDL Advance (Section 1110(e)(6) of the CARES Act). If you received an EIDL Advance in excess of or equal to the amount of your PPP loan, you will not receive any forgiveness on the PPP loan because the amount of the EIDL Advance is deducted from the PPP loan forgiveness amount.

UPDATES TO YOUR DEFERRAL PERIOD:

Clarifications to the SBA Paycheck Protection Program state that if you submit to your lender a Loan Forgiveness Application within 10 months after the end of your loan forgiveness covered period, you will not have to make any payments of principal or interest on your loan before the date on which SBA remits the loan forgiveness amount on your loan to your lender (or notifies your lender that no loan forgiveness is allowed). Your lender must notify you of remittance by the SBA of the loan forgiveness amount (or notify you that the SBA determined that no loan forgiveness is allowed) and the date your first payment is due. If the loan is fully forgiven, the borrower is not responsible for any payments.

If only a portion of the loan is forgiven, or if the Forgiveness Application is denied, any remaining balance due on the loan must be repaid by the borrower on or before the maturity date of the loan. The borrower is responsible for paying the accrued interest on any amount of the loan that is not forgiven. Interest accrues during the time between the disbursement of the loan and the SBA remittance of the forgiveness amount.

If you do not submit to your lender a Loan Forgiveness Application within 10 months after the end of your loan forgiveness covered period, you must begin paying principal and interest after that period.

For example, if a borrower's PPP loan is disbursed on June 25, 2020, the 24-week period ends on December 10, 2020. If the borrower does not submit a Loan Forgiveness Application to its lender by October 10, 2021, the borrower must begin making payments on or after October 10, 2021.

A complete Q&A from the U.S. Small Business Administration regarding the deferral period is available through this link: SBA PPP Loan Forgiveness FAQs - August

While we do our best to present clear and accurate information to you from the SBA they are ultimately responsible for the rules of the program and they can change them at any time. Any discrepancy between our communications and the SBA's interpretation of the program will be governed by the SBA's guidance.

Please let us know if you have any questions by contacting: caresloans@sccountybank.com.

Thank you,

Santa Cruz County Bank

July 27, 2020:

Hello,

We know you are eager for updates on the PPP Forgiveness Application process, so are we. At this time, the Small Business Administration (SBA) is not yet processing applications and is continuing to finalize the forgiveness requirements.

For now, we want to make you aware of a few things you can do to prepare. Below is some guidance on what to expect in the future. We encourage you to check our website for the most up-to-date information. And, we will certainly let you know when you can apply online for forgiveness through the loan portal.

What can I do now to prepare for the forgiveness application?

Prepare documents to verify how you used your loan. You can visit the

SBA’s website

for a comprehensive list of materials and forgiveness rules.

Decide which "Covered Period" applies to your business. Either 8 weeks or 24 weeks after your loan was disbursed.

Here’s what to expect in the future:

You will have 10 months to apply for loan forgiveness after the end of your "Covered Period." Depending on when you received your loan, your "Covered Period" is either an 8 or 24-week period after you received your PPP loan funds.

We are currently waiting on SBA to open their forgiveness application process to lenders. Once they have, we will communicate the process to you. Then, once we receive your loan application, we will review it within 60 days, and then submit a decision to the SBA. The SBA will then have 90 days to review the submission.

For loans approved prior to June 5, 2020, any amount that is not forgiven will be treated as a two-year loan with a 1% fixed interest rate. For loans approved on or after June 5, 2020, any amount that is not forgiven will be treated as a five-year loan with a 1% fixed interest rate.

Again, we will be in communication with you once the SBA has determined and finalized forgiveness requirements.

July 7, 2020:

The Small Business Administration and Treasury Department have announced that they will publicly release certain information about PPP borrowers.

For loans of $150,000 or more, the data released includes business names, addresses, NAICS codes, ZIP codes, business type, demographic data, non-profit information, jobs supported, lender name, and dollar ranges for loan amounts. Dollar amounts are being disclosed in ranges of $150,000-$350,000, $350,000-$1 million, $1 million-$2 million, $2 million-$5 million, and $5 million-$10 million. Loans of $150,000 and up account for nearly three-quarters of the dollar volume of PPP loans.

For loans below $150,000, the agencies will not release business names but will report loan totals, aggregated by ZIP code, by industry, by business type, and by various demographic categories. The agencies have noted that PPP borrower applications disclose that this information could become public.

Santa Cruz County Bank is not voluntarily releasing this information and is not calling for its publication. The decision to publish PPP borrower and loan information is a result of actions from Congress and the SBA and Treasury, which oversee and administer the PPP and are responsible for the program’s implementation, terms, and conditions. We are proud to participate in the PPP and help businesses navigate this challenging COVID-19 environment.

June 23, 2020:

Subject: Important Updates, PPP Expense and Forgiveness Reporting Instructions

Hello!

We are writing to inform you of next steps and updates to our Paycheck Protection Program Loan Portal to help you facilitate expense reporting and forgiveness with the SBA.

The good news is you have not missed any deadlines. While you have plenty of time to complete this process, we are pleased to provide you a real time expense tracking system to upload clear, concise, and accurate documents to engage you early. We are here to help make your expense reporting and forgiveness as simple and accessible as possible.

IMPORTANT STEPS:

Login to Portal: https://sccountybank-ppp-application.prod.apps.monjaco.com/portal/

Now, after your login to the Loan Portal, your application status will read, “Forgiveness Application in Progress”. When you visit the “Required Items” section of your application, you will see the “Loan Forgiveness: Document Uploads Section”. Similar to the application process, the Forgiveness process describes the documents needed to ensure your loan is forgiven.

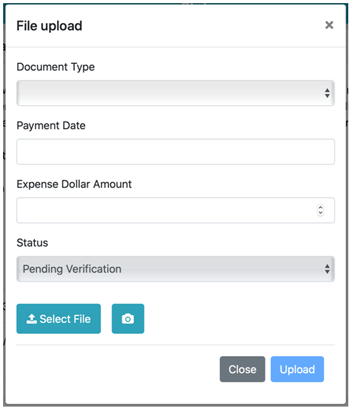

Upload Documentation:

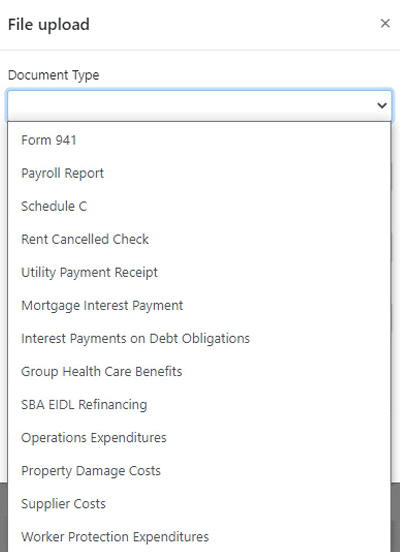

You will be asked to categorize each document you upload, and provide details about that document, including the date of the expense and the dollar amount. Each time you upload a document, the associated expenses will preliminarily populate your Summary of Forgivable Expenses Table. This Summary Table will help you keep track of your targets for forgiveness and cumulative eligible expenses uploaded to date.

FAQ & Support:

A visual “How To” guide is available to help you navigate the expense reporting and forgiveness process at: PPP Loan Forgiveness Guide

If you experience any errors, confusion, or problems, we are available to help!

Email us: caresloans@sccountybank.com.

April 24, 2020:

Lawmakers have approved an additional $320 billion in funding for the lapsed Paycheck Protection Program. New guidance from the US Small Business Administration has been issued which states that companies applying for coronavirus relief funds must certify that the loans are necessary and that they cannot tap other sources of funding.

April 16, 2020:

The Small Business Administration has stopped accepting applications for Paycheck Protection Program loans as the processed loan volume has reached the $349 billion level authorized by the CARES Act. The available funds have been exhausted, therefore SBA will no longer accept applications from lenders to make PPP loans.

We are awaiting word on whether lawmakers will be extending funds for the CARES Act Loan programs.

We are continuing work to process our existing queue of applications so we can be ready. If you have applied through us, we’ll contact you with questions and email you once we determine whether additional funding is available.

Who Is Eligible?

What is needed to determine Eligibility?

Business must be operational as of February 15, 2020 and had employees for whom it paid salaries and payroll taxes, or a paid independent contractor.

How do you calculate the total loan amount?

Average eligible monthly payroll costs, excluding compensation above $100,000 in wages (based on prior 12 months) multiplied by 2.5 (represents months) or $10 million whichever is less.

What is the allowable use of proceeds?

Allowable uses of the loan include eligible payroll support (eligible employee salaries which excludes compensation above $100,000 in wages, paid sick or medical leave, insurance premiums), interest paid on a mortgage (excludes any prepayment of or payment of principal) or rent, and utility payments.

Is it true I won't have to pay back my loan?

What is the term of the loan?

2 year amortizing loan with no prepayment penalties. Payments on this SBA 7(a) loan can be deferred for 6 months to a year.

What are the interest rate and SBA guarantee fees for this loan?

The rate is 1% and SBA is waiving the guarantee fee.

What collateral is required?

The loan will be unsecured.

Are personal guarantees required?

No

Is the Credit Elsewhere Rule enforced?

No

Other Conditions and Requirements

What will be the Required Application Document Checklist?

Below is a list of documents that will likely be needed to process the SBA 7 (a) CARES Act Loan

On May 4, 2021, the SBA stopped accepting new PPP applications. In light of this program update, Santa Cruz County Bank is no longer accepting PPP applications. Santa Cruz County Bank remains committed to providing our customers support throughout the PPP Forgiveness process.

Please visit the SBA's website for up to date information regarding the new program rules, regulations, and FAQ.

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

How You Can Help Get Vital Funding Into Our Community

Let us be your one-stop banking partner. Your relationship really does matter to our community and together, we can make a huge impact on our local economy.

Community banks reinvest deposits back into our community. Every deposit account with Santa Cruz County Bank is part of an important economic cycle. Your local deposits become loans to help local businesses start-up, expand, save jobs, survive the pandemic, and thrive.

We invite you to establish a full banking relationship with us that includes all of your deposit accounts. Your deposits with us matter more now than ever before.

Important updates on the Paycheck Protection Program

The SBA's latest forgiveness requirements are available at https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program . Borrowers of $150,000 and less may utilize a short-form application (3508-S) which does not require the borrower to submit documentation prior to submitting their forgiveness application to the lender.

Borrowers with loans greater than $150,000 may complete the EZ-form (3508-EZ) or the 3508 standard application. The borrower is required to show proof of eligible payroll and non-payroll costs incurred during their covered period, prior to submitting their forgiveness application to the lender to satisfy relevant Federal, State, local or other statutory or regulatory requirements, or in connection with an SBA loan review or audit.

All borrowers must retain all such documentation in their files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of the SBA, including representatives of its Office of Inspector General, to access such files upon request.

If you missed a communication from us, please see the Recent Communications section on this page. We recommend you review this SBA Guide to PPP Forgiveness (pdf file) to get started.

| Paycheck Protection Program (PPP) | |

|---|---|

| Maximum Loan Amount | For most borrowers, it will be equal to 2.5 times 2019 monthly payroll expenses up to $2 million. For certain industries such as restaurants and hotels, maximum loan amount will be equal to 3.5 times 2019 monthly payroll expenses, up to $2 million. |

| Forgivable Amount | Up to the principal balance for loan proceeds used for qualified purposes. |

| Interest Rate | 1% |

| Fees | $0 |

| Maximum Loan Term | 5 Years |

| Use of funds | Eligible use of funds categories have been expanded and the borrower may now spend those funds over a period they choose form 8-24 weeks. |

| Prepayment Penalty | $0 |

| Eligibility | First time borrowers are eligible as well as borrowers who received PPP loan money in the first rounds. Borrowers will need to demonstrate a 25% reduction in sales, in any quarter of 2020 compared to the same quarter of 2019. |

Approved to offer SBA loan products under SBA's Preferred Lender program.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Continue to https://sccountybank-ppp-application.prod.apps.monjaco.com/portal/loans

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Continue to https://home.treasury.gov/policy-issues/cares/assistance-for-small-businesses

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Continue to SBA Press Release on Paycheck Protection Program transparency

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

Santa Cruz County Bank has no control over information at any site hyperlinked to or from this site. Santa Cruz County Bank makes no representation concerning and is not responsible for the quality, content, nature, or reliability of any hyperlinked site and is providing this hyperlink to you only as a convenience. The inclusion of any hyperlink does not imply any endorsement, investigation, verification or monitoring by Santa Cruz County Bank of any information in any hyperlinked site. In no event shall Santa Cruz County Bank be responsible for your use of a hyperlinked site.

"The funds we are receiving from Santa Cruz County Bank through the PPP loan program allow us to retain staff at a time when we are not able to hold our largest fundraiser of the year. This loan allows us to support the youth and families in our program during the crisis by providing our services virtually so that isolated and at-risk youth stay connected and are supported. This funding allows us to pivot in how we are providing services and how we will raise funds moving forward in these uncertain times. We are grateful and thankful to the Bank for their tireless commitment to businesses including nonprofits at this time - numerous businesses in our county are benefiting as a direct result and ultimately our entire community benefits."

- Aimee Mangan, Executive Director, Big Brothers Big Sisters, Santa Cruz County

"Habitat Monterey Bay is humbled by the generosity of SC County Bank and their commitment to this community. It has been truly a pleasure working with their caring team on our PPP loan, WISH program for homeowner mortgage financing, and corporate sponsorships over the past 10+ years. Their support brings an ease to dealing with stressful transactions that really sets them apart."

- Betsy Powers, Resource Development Director, Habitat for Humanity Monterey Bay

"We have known for a long time that Santa Cruz County Bank was unparalleled in their customer service and commitment to their local business community. Even with that knowledge, their hard work and dedication during this time has gone above and beyond. They are working so hard every day to ensure that the rest of us can keep working too. They are truly an incredible partner to this community and our local businesses."

-Jamileh Cannon, Founding Partner & Principal Architect, Workbench

You are about to leave our website. By clicking on the hyperlink provided below, you will land on our partner's site for the processing of your Paycheck Protection Program loan.

If you do not see our logo on the page, which is hosted by Monja, please contact us.